The Lightning Network was originally designed to completely remove limitations on transaction scaling while keeping bitcoin's trustless and permissionless qualities. It gained early momentum with El Salvador's adoption of Bitcoin as legal tender, offering a faster, cheaper, and more scalable solution for Bitcoin as a medium of exchange. That moment sparked an explosion of grassroots activity, as node operators rushed to bootstrap the payment network and support real-world Bitcoin transactions. Amboss emerged in this wave, launching our node explorer to help connect participants and accelerate the network's growth.

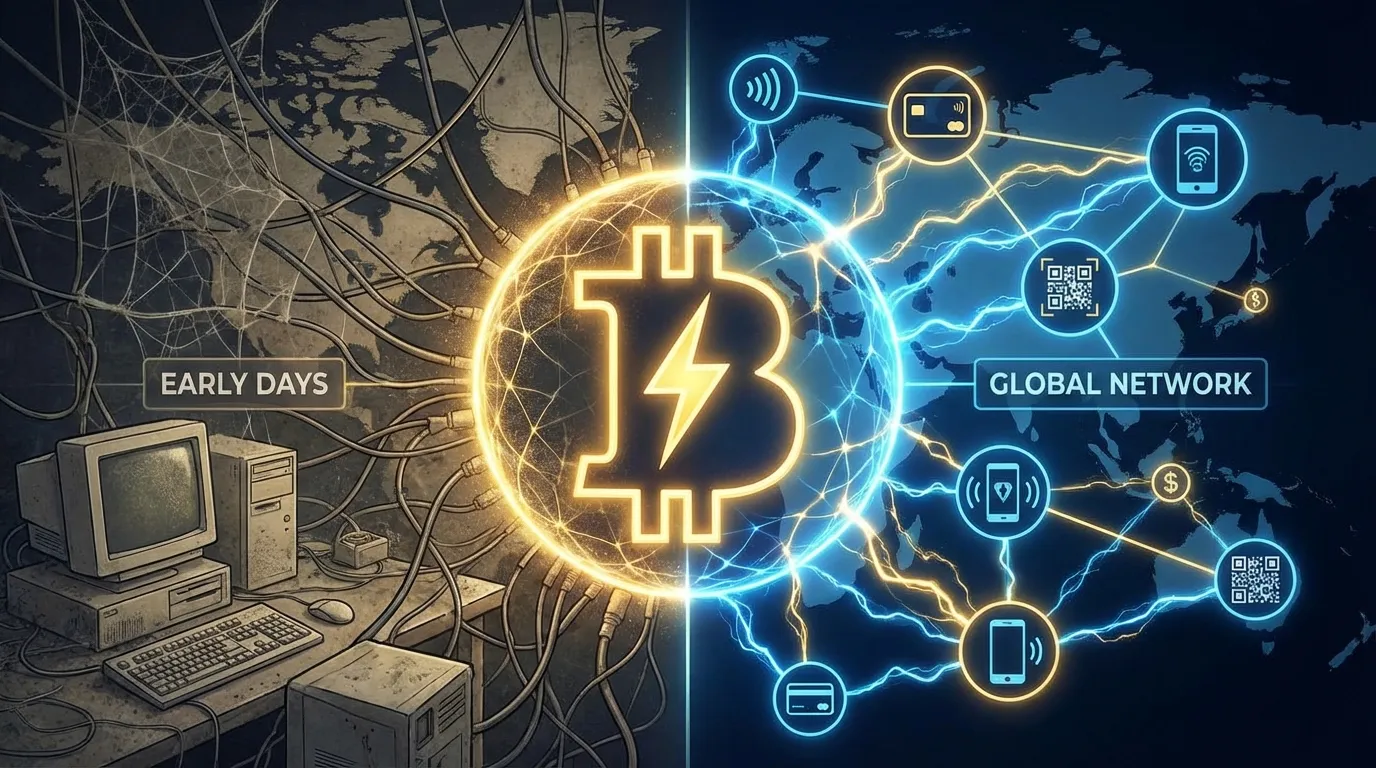

However, the early days were clunky: users had to manually open payment channels and establish routes just to send or receive sats. The idea was promising, but usability was limited and adoption slow.

Fast forward: Lightning has real world use and supports businesses driving bitcoin adoption globally as a medium of exchange. With the foundational structure of Lightning built, growing use cases, and expanding payments infrastructure, Lightning has grown into a resilient decentralized network ready for the next step.

Lightning Has Evolved

Lightning is no longer just for micropayments. It's becoming the decentralized payment layer for Bitcoin, powered by infrastructure, driven by capital, and sustained by real economic activity. What started as a layer for small fast transactions has matured into a capital-backed, scalable financial network.

The network's future doesn't rely on hype or speculation. It's built on a foundation of liquidity, throughput, and utility. It's being fueled by institutions who see Bitcoin not just as an asset to hold, but as capital to activate.

Bitcoin as a medium of exchange finally has the foundation needed to drive its adoption as a global monetary system for settlement.

Building Infrastructure for Real Adoption

That's where innovation stepped in. At Amboss, we began developing tools to support Lightning infrastructure. Starting as a lightning node explorer built to optimize payment paths to Magma streamlining node management and enabling liquidity leasing to flow more efficiently through decentralized coordination.

These products removed friction, making Lightning more usable and reliable for both individuals and institutions.

Infrastructure alone wasn't enough.

What Lightning really needed is deep, sustainable capital — not just from retail users, but from Bitcoin treasuries and institutions willing to deploy their assets as working capital.

From Micropayments to a Capital-Backed Payments Network

Micropayments were just the beginning. They proved the concept, but the real breakthrough came when institutional capital started to enter the picture.

Treasury-grade capital is now flowing into Lightning not to speculate, but to enable payments — and access yield by doing so. By providing liquidity, these capital providers make it possible for more payments to be routed through the network quickly and efficiently. And here's where it gets powerful:

More capital lowers payment costs → Lower costs drive adoption → Adoption increases yields → Yield attracts more capital

This is the Lightning Liquidity flywheel, and it's turning Lightning into a scalable, decentralized financial network.

Unlike the traditional payment system, where a few centralized intermediaries (Visa, Mastercard, banks) capture most of the value, Lightning allows anyone to act as a payment processor. You provide liquidity, the network uses it to settle payments, and you earn a share of the routing fees — without needing permission or a license.

The 2-3% fees that merchants pay today to card networks? Those are replaced with value flows directly to the network's participants.

Why This Is Now Viable at Scale

This dynamic wasn't possible in Lightning's early days because the network lacked both infrastructure and capital.

Thanks to platforms like Magma (a decentralized liquidity marketplace) and Rails (Bitcoin-native yield), capital allocation is easier, smarter, and more efficient. Bitcoin treasuries no longer have to choose between passive storage and high-risk DeFi. Deployed BTC becomes payment infrastructure and increases throughput in a network that's:

- Always on (24/7)

- Globally interoperable

- Self-custodial and decentralized

- Backed by real usage, not hype

Lightning Network had previously been constrained to micropayments, largely due to difficulty sourcing liquidity and experimental channel management strategies. Transaction reliability and scalability were real challenges, especially for larger settlements. But that's changed.

With the emergence of products from Amboss, the network can now optimize for payment reliability, network efficiency, and economic routing. Liquidity is no longer trapped; it's market-driven.

This shift is what makes Lightning finally viable at scale, not just for sending a few sats, but for supporting a high-volume, global payments system with deep liquidity and sustainable incentives.

Lightning Payments, Now Enterprise-Ready

Today, Lightning isn't just a concept — it's a production-grade payment system ready for high-volume businesses. That's why we partnered with Voltage, a leading Lightning infrastructure provider, to bring instant, low-cost payment processing solutions directly to e-commerce, merchants, exchanges, and financial apps.

Together, we're enabling businesses to process payments for a fraction of traditional fees — without intermediaries, chargebacks, or settlement delays. Even better: with Amboss's liquidity intelligence and routing yield, payments can now pay you back, turning what was once a cost center into a source of revenue.

Adding Intelligence to Lightning's Liquidity Layer

As institutional capital flows into the Lightning Network, simply adding more liquidity isn't enough — it must be allocated intelligently to maximize payment success and network efficiency.

That's why we developed MPFlow — an AI agent that uses deep graph reinforcement learning to optimize liquidity placement on the Lightning Network.

MPFlow treats Lightning as a living, evolving graph, learning where to place capital in real time for the greatest possible impact. It doesn't rely on static heuristics or guesswork. Instead, it learns from the network's topology and adapts dynamically as conditions change. In controlled tests using real-world data, MPFlow increased payment throughput by up to 11.3% compared to existing algorithms. It now manages over $5M in BTC liquidity across 200+ channels in production, powering more reliable and efficient payments within our Rails Cluster.

This marks a foundational shift: MPFlow moves Lightning toward becoming a self-optimizing capital network — where liquidity flows where it's needed most, driven by data, and aligned with payment demand.

The Shift: From Micropayments to Capital Markets

Perhaps the most exciting development is that Lightning is evolving beyond a simple payments protocol into a Bitcoin-native capital market.

With tools like LINER (Lightning Network Rate), participants can now benchmark cost, yield, and liquidity performance — just like they would with credit card interchange fees or fixed income interest rates.

We're witnessing the early formation of a financial market native to Bitcoin: where rates are set by real-time liquidity conditions, and where capital deployment is tied to payment throughput, not speculation.

Lightning is no longer a novelty. It's becoming infrastructure.

Bitcoin Treasuries: From Store of Value to Medium of Exchange

For institutional holders of Bitcoin, Lightning represents a new paradigm. Rather than letting Bitcoin sit idle as a store of value, treasuries can now deploy it into the Lightning Network to generate real yield, support payment activity, and actively participate in a decentralized financial system.

This dual role — store of value + medium of exchange — is unique to Bitcoin in the Lightning era. It allows treasuries to differentiate themselves, improve capital efficiency, and help build the very infrastructure that drives adoption. As capital flows into the network, it unlocks more payments, which in turn creates more opportunity for yield, creating a positive feedback loop that benefits the entire ecosystem.

The Next Step: Real-World Payments That Pay You Back

With infrastructure like Voltage powering payments integrations and Amboss optimizing liquidity and yield, the Lightning Network is evolving into a self-sustaining global payments system.

The barriers are gone:

- Accept instant Bitcoin & Stablecoin payments without managing liquidity yourself

- Reduce payment costs by 95%+ compared to legacy rails

- Access yield for the payments flowing through your node

The Lightning era of “Payments that Pay You Back” has officially begun.

Get in touch to take advantage of your capital to access yield through Lightning payments.