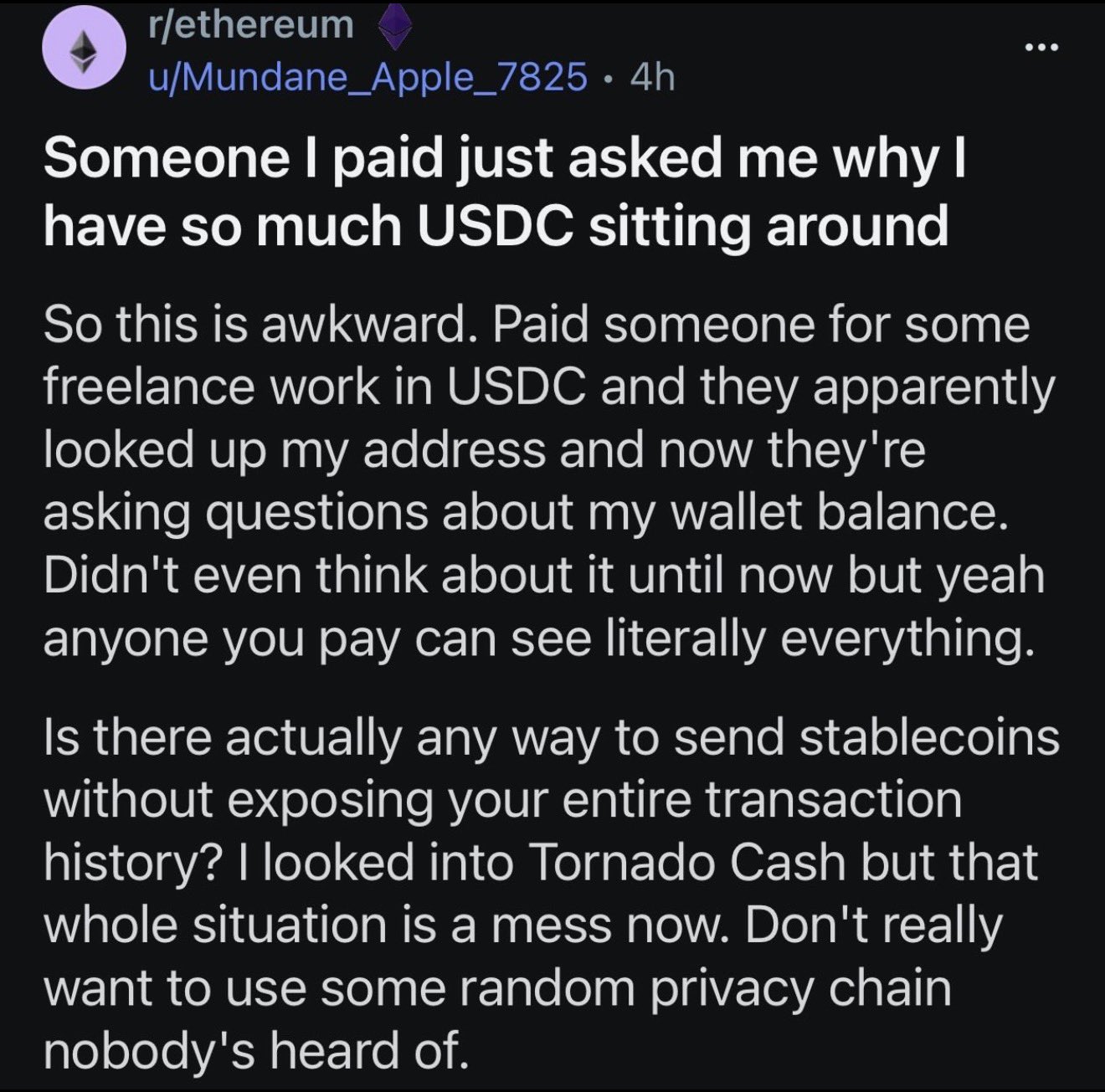

A recent post circulating online captured a moment many stablecoin users eventually experience:

That awkward realization isn't a personal error; It's systemic.

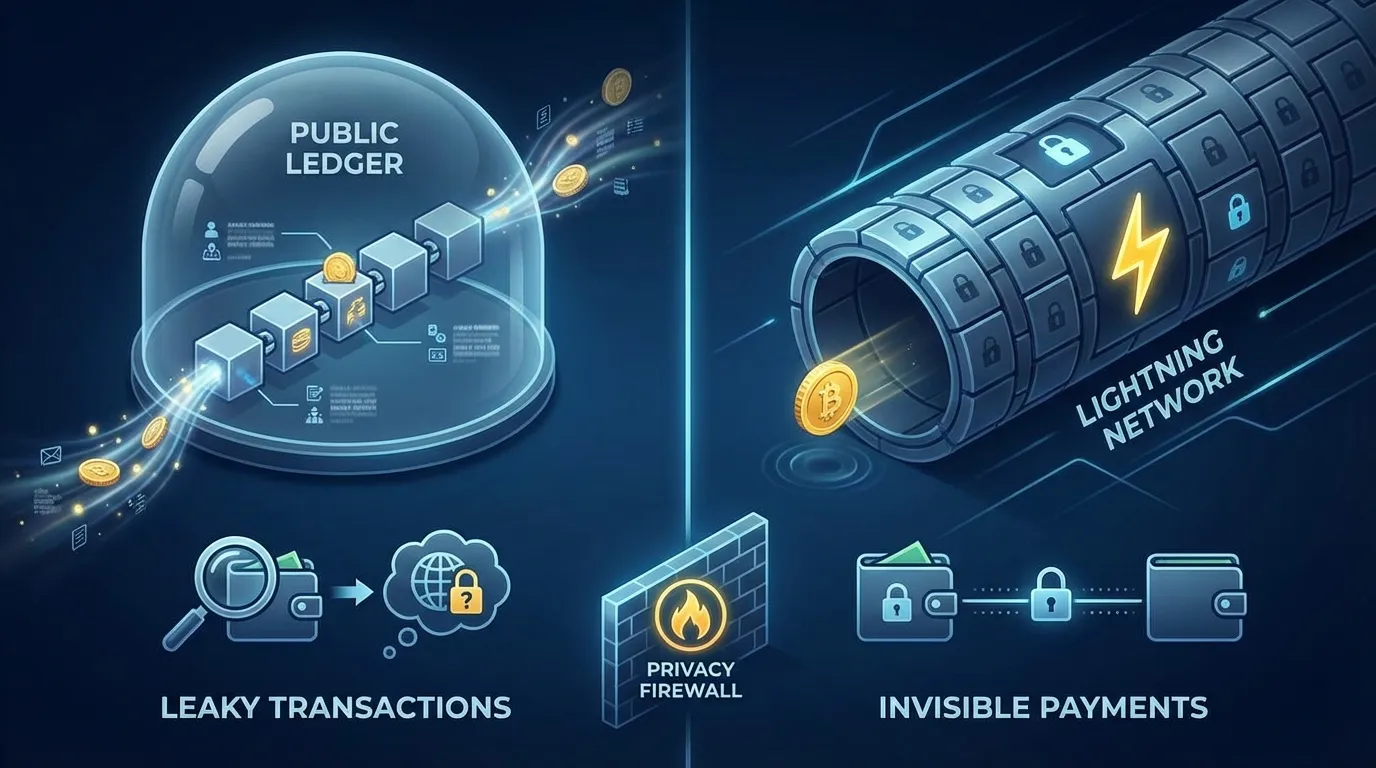

On most blockchains today, stablecoins leak financial information by default (balances, transaction history, and counterparties) to anyone you interact with. In 2025, this has become one of the most urgent and widely acknowledged blockers to mainstream stablecoin adoption.

The Stablecoin Privacy Reckoning

Stablecoins now process volumes rivaling (and in some cases exceeding) traditional payment rails. But there are privacy concerns.

The core issue is simple:

Account-based blockchains expose too much information to too many parties.

When you send USDC or USDT on Ethereum, Tron, or similar chains:

- The recipient sees your entire wallet balance

- They can inspect every past transaction

- Competitors can map revenues, suppliers, payroll

- Attackers gain targeting intelligence

- Surveillance becomes trivial

Why “Privacy Layers” Don't Fix the Root Problem

In response, the ecosystem has shifted toward:

- Zero-knowledge stablecoins

- Encrypted balances

- Selective disclosure systems

- Privacy pools and compliance proofs

These approaches aim to hide data on top of public ledgers, balancing privacy with regulation.

While valuable, they share a common limitation:

They still rely on a public ledger where every interaction is permanently recorded - even if some details are hidden.

Even when amounts are hidden:

- Addresses remain linkable

- Participation itself is visible

- Complex cryptography increases risk and friction

- Regulatory ambiguity persists

Privacy becomes conditional, opt-in, and fragile — not default.

Lightning Network: Privacy by Not Publishing Transactions

Lightning takes a fundamentally different approach.

It doesn't encrypt transactions. It doesn't mix them. It doesn't shield them.

It simply doesn't broadcast them at all.

1. No Global Ledger of Payments

Lightning payments:

- Are settled off-chain

- Leave no public transaction record

- Do not update a visible balance

There is no block explorer where someone can inspect your financial life.

2. Onion-Routed Payments

Lightning uses onion routing:

- Each hop knows only the previous and next hop

- No intermediary sees sender + receiver

- No global observer sees the full path

Compare this to account-based chains, where every node sees everything.

3. No Persistent Account Identity

Lightning does not use accounts:

- No reusable “balance address”

- No permanent transaction history

- Invoices are one-time and unlinkable by default

The person you pay learns only that they were paid — nothing else.

Privacy as the Default, Not a Feature

This is the architectural distinction most discussions miss.

| Property | Account-Based Stablecoins | Lightning |

|---|---|---|

| Balance visibility | Public | Private |

| Transaction history | Permanent | Off-chain |

| Counterparty insight | Full wallet | Single payment |

| Privacy | Opt-in | Default |

Lightning restores what people intuitively expect from payments:

- Paying someone doesn't reveal your net worth

- Receiving money doesn't expose your business

- Financial privacy is normal, not suspicious

Stablecoins on Lightning: Taproot Assets

Until recently, Lightning's privacy benefits were limited to BTC.

That is no longer true.

Taproot Assets enable:

- Issuance of assets (including stablecoins)

- Anchored to Bitcoin's UTXO model

- Inflight cross-currency exchanges over Lightning channels

Why This Matters

Stablecoin payments via Taproot Assets:

- Inherit Lightning's off-chain privacy

- Have no public balance lookups

- Expose no transaction history

- Avoid account-based leakage entirely

To the recipient:

- A payment arrives

- Nothing else is revealed

This achieves what many systems aim for — without adding cryptographic or regulatory complexity.

Privacy and Compliance Are Not Opposites

A key theme in 2025 is that privacy and compliance are converging, not diverging.

Lightning aligns naturally with this direction:

- No anonymity set to manage

- No mixer contracts

- No public data to exploit

- Audits and reporting happen at endpoints, not globally

Privacy comes from transaction locality, not secrecy.

This mirrors how traditional finance works — and why institutions increasingly view Lightning as a viable payment layer rather than a regulatory risk.

Why This Isn't “Just Another Privacy Chain”

Many users are understandably wary of:

- Obscure privacy blockchains

- Experimental cryptography

- Thin liquidity

- Delisting risk

Lightning avoids these pitfalls:

- Runs on Bitcoin

- Uses simple, battle-tested primitives

- Blends into normal network traffic

- Already processes real economic activity at scale

Privacy emerges as a property of the network, not a marketing promise.

The Bigger Picture

The stablecoin privacy debate is no longer niche.

It's existential.

Transparent money cannot function as:

- Cash

- Payroll

- Retail payments

- Institutional settlement

Lightning demonstrates a different path:

- Don't hide transactions

- Don't expose them in the first place

With Taproot Assets, this model finally extends to stablecoins.

Conclusion

If sending someone money exposes your financial life, then the system is broken — not the user.

Account-based stablecoins optimize for auditability at the cost of privacy. Lightning flips this equation:

- Privacy by default

- Compliance at the edges

- No global financial surveillance

That architectural choice may be the difference between stablecoins as a niche settlement tool — and stablecoins as real money.