Today, I want to discuss a project that is very close to our hearts and represents a significant step forward for our mission of redefining financial systems - the Lightning Network Rate (LINER). Our journey to create LINER was driven by a singular vision: To establish a more inclusive, community-controlled financial network. Traditional payment networks, despite their widespread use, have their limitations. They can often be exclusionary, dominated by a few institutions, which have failed to reach beyond the privileged, banked population of the world.

We witnessed a gap in the market. Businesses, both large and small, needed a reference for what an alternative to traditional payment network will cost and what the opportunities are. That's why we introduced LINER.

LINER is a dual index of payment processing costs and self-custodial yields on the Lightning Network.

LINER is a dual index of payment processing costs and self-custodial yields on the Lightning Network.

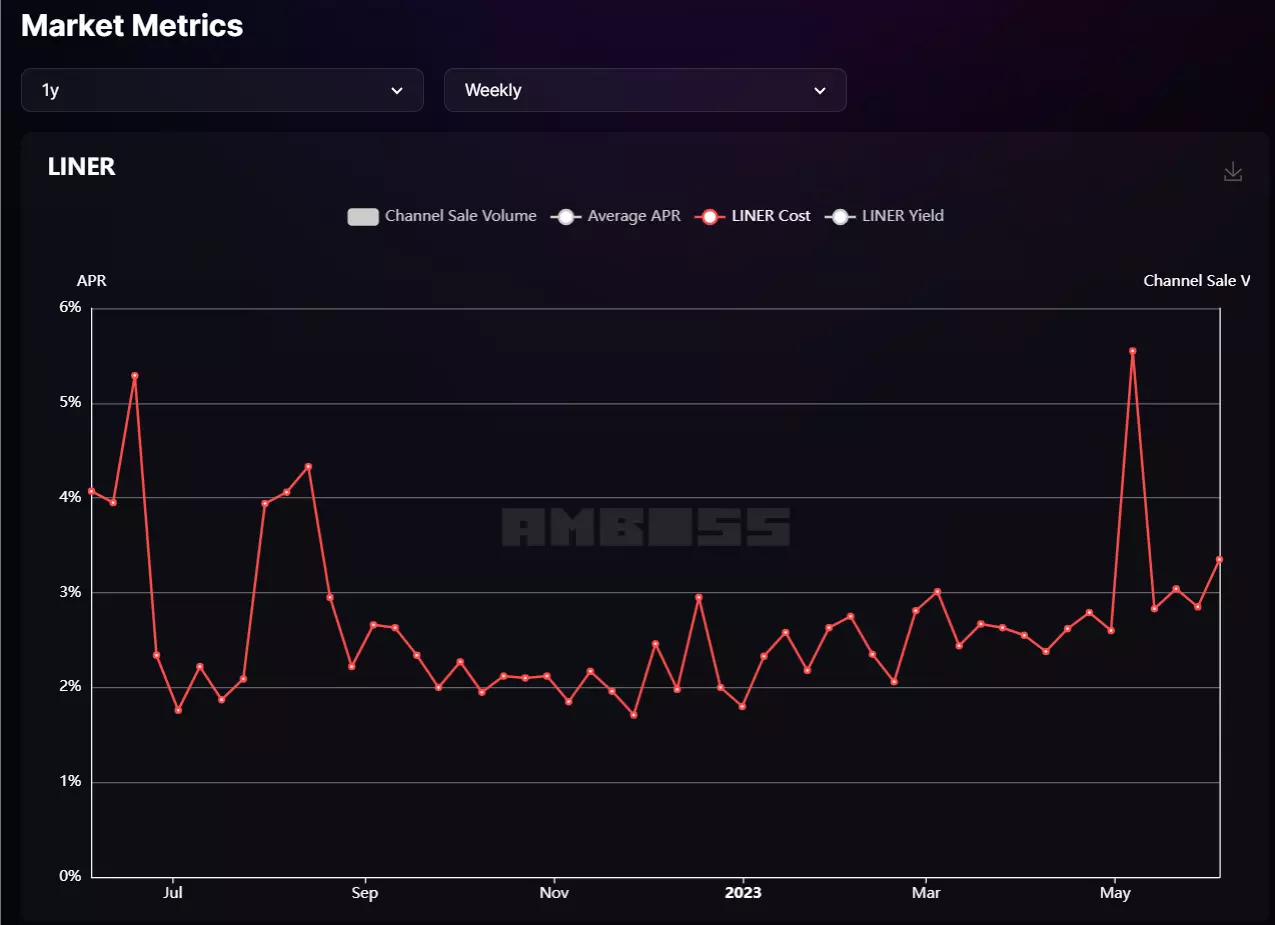

The LINER cost, viewable on our stats dashboard with Amboss Alpha, provides a direct cost comparison to payment processor fees. Payment processor fees in the US are often greater than 3% in domestic cases. For international payment card settlement, those fees can be far greater. More expensive still is the cost of settlement without payment card infrastructure or with remittances (cross-border payments).

The LINER Cost provides a direct cost comparison to payment processor fees, derived from the Lightning Network market.

The LINER Cost provides a direct cost comparison to payment processor fees, derived from the Lightning Network market.

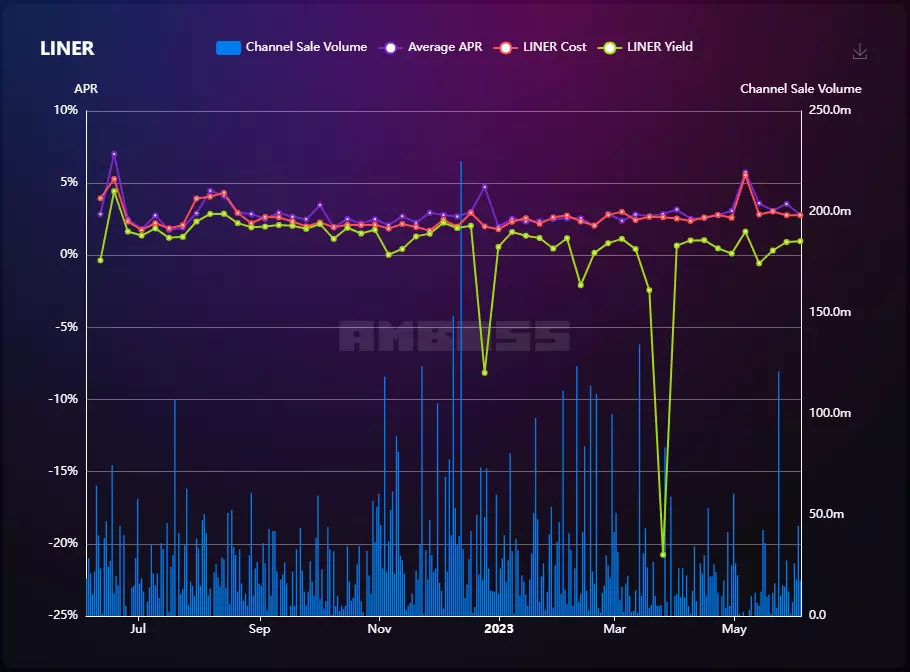

The LINER Yield, seen here, serves as a revolutionary index that provides genuine yield rates on bitcoin used in the Lightning Network. By doing so, it enables businesses to realize the full potential of participating in this decentralized financial system. Unlike traditional financial systems where rates are set by a central authority, LINER operates in a free market environment, echoing our core belief in the power of community-led decisions and operations.

The market today is dominated by hobbyists who don’t have the benefits of large scale merchant influence, but as the demand for lightning payments increases, so too will efficiency. With merchants scaled up, we’ll see the LINER yield increase since sold channels can be batched together, thereby reduced the on-chain footprint and on-chain cost.

The LINER Yield serves as an index of the yield earned on bitcoin after on-chain costs are considered.

The LINER Yield serves as an index of the yield earned on bitcoin after on-chain costs are considered.

Notes on negative yields: The LINER yield takes into account the on-chain cost of channel opens and predicts the cost of a future channel close. Until the channel is closed, we assume that the channel close cost is equal to the channel open cost. Channel opens are made under a strict time limit whereas channel closes are not, so the fee for a channel open is expected to be higher than the channel close. The LINER yield will be revised (usually upwards) when we receive this new close cost data. While this market is still small and dominated by hobbyists, there is occasionally very poor fee estimation made by the channel seller, leading to negative yields. Negative yields are avoidable with good fee estimation practices.

At the same time, LINER addresses a crucial aspect of digital finance: risk. By presenting an alternative free from credit risk, it provides a risk-appropriate avenue for enterprises, particularly in the aftermath of the CeFi yield platform debacle in 2022, where customers of yield platforms learned that the custodian of their funds were insolvent or had irresponsible amounts of leverage.

We’re not just stopping at the introduction of an innovative index. Our endeavor to make digital finance more accessible also extends to Magma, our marketplace for buying and selling Lightning channels. These channels form the lifeblood of our network, creating pathways for secure, quick payments. Our goal with Magma is to offer everyone the opportunity to participate in and benefit from the disruption of payment networks, without the massive barriers to entry.

We believe in a world where financial systems are voluntaristic, transparent, and owned by the community. We see a future where every individual, every enterprise, has an equal opportunity to participate in and benefit from digital finance. We’re embodying this by showing the order details of every channel sold on Magma and the annualized price paid for them, seen in our stats dashboard. This provides Alpha tier subscribers with deeper insights on pricing, timing, and offer sizing.

Our journey towards creating this future has only just begun. With LINER, we're taking the first major step. It’s not just about returns or yields, but about showing the possibilities for disrupting payment networks that are decades out of date and reducing the cost of commerce globally. This is paving the way for a more inclusive and sustainable financial ecosystem.

Our vision for a decentralized, community-controlled financial world is ambitious, and we acknowledge the challenges that lie ahead. However, we are confident in the abilities of the community when presented with the right tools that demonstrate the transformative power of our technology.

Onward,

Jesse Shrader

CEO, Amboss Technologies