Lightning has quietly crossed a threshold: it's no longer just a payment rail — it's becoming a productive financial layer for businesses.

Lightning has evolved in 2025 to support high-value, high-volume business critical-payments, including $100,000+ transactions, payroll, global wires, exchange settlements, and treasury strategy.

But there's a part of Lightning that most teams haven't figured out yet: accessing yield while you move payments.

Turning Lightning Volume Into Bitcoin Rewards

Teams that adopted Lightning early understood the direction payments were heading. But accepting Lightning payments is only the first step. The next wave of advantage comes from layering a strategy on top of existing payment flows to automatically generate yield without adding operational overhead.

Earlier this year at Bitcoin Vegas, Block revealed that their Lightning node was earning 9.7% annualized yield simply from routing payments across the network. That's not experimental — it's a repeatable strategy now being adopted by forward-thinking teams.

At Amboss, we've made it simple for businesses to do the same. Our Payments Bundle now includes the Yield Gateway, turning your Rails node into a yield-seeking gateway for payments.

How the Yield Gateway Actually Works

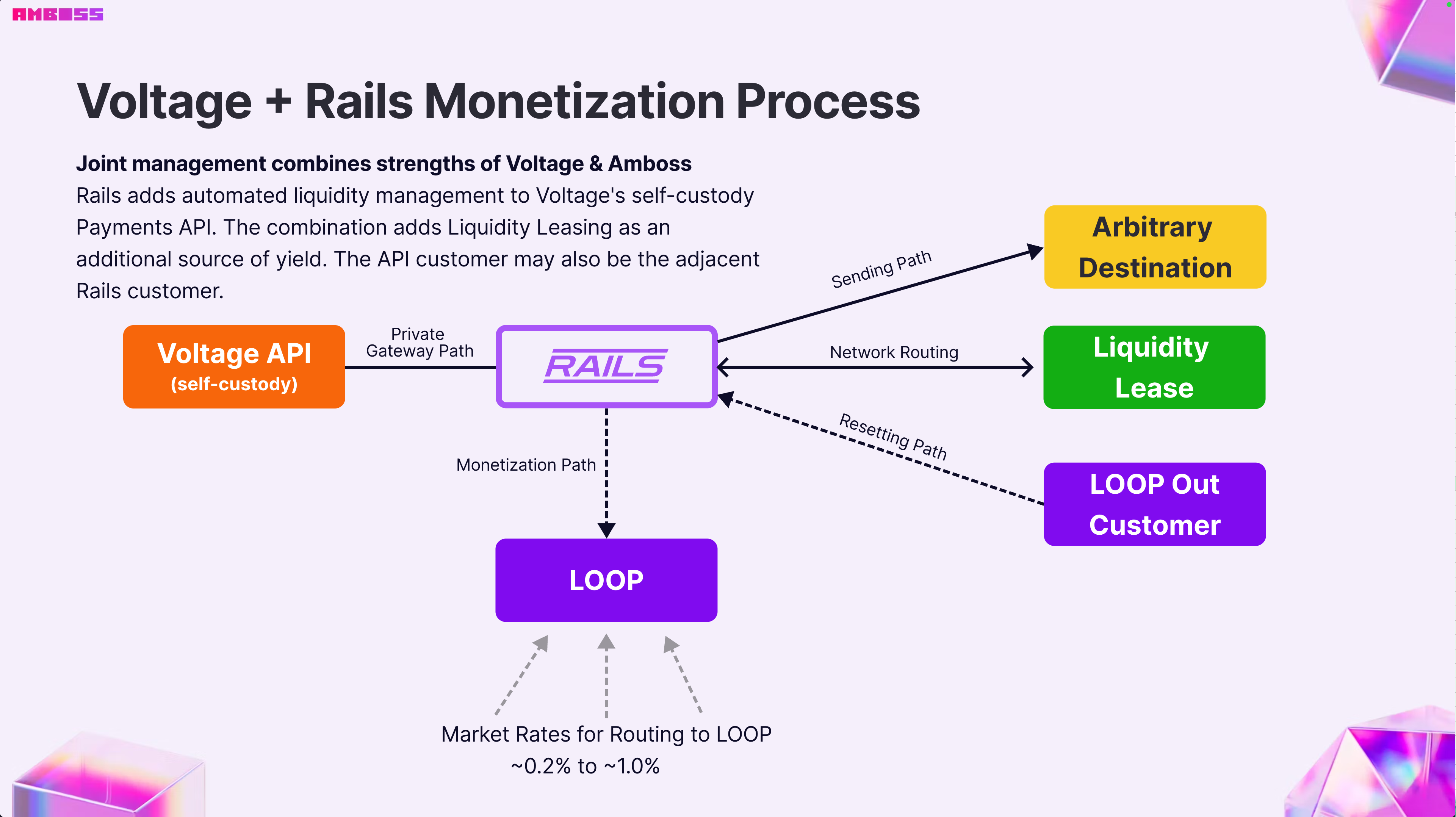

The Yield Gateway works by combining routing economics with intelligent liquidity allocation — turning Lightning from a simple transport layer into productive infrastructure.

Instead of relying on a single mechanism, it layers complementary strategies that reinforce each other as payment volume scales.

Routing Through Partner Nodes (via the Voltage Payments API)

High-volume Lightning payments are routed through well-capitalized, professionally operated nodes on the network.

What this unlocks for operators:

- Higher payment reliability for large and time-sensitive transactions

- Exposure to routing economics without running a complex routing operation

- Bitcoin rewards generated directly from payment flow, not idle capital

In practice, your payments don't just clear — they contribute to network activity that pays you back.

In practice, your payments don't just clear — they contribute to network activity that pays you back.

Liquidity Leasing with Magma

Magma adds a second yield stream by allocating liquidity where the network needs it most.

What this unlocks for operators:

- Additional yield from unused or underutilized liquidity

- Predictable performance for high-value payments

- Reduced need for manual channel management

Liquidity stops being a sunk cost and becomes a productive asset.

What Adding a Yield Strategy Looks Like

Adding a yield strategy is simple:

- Process Lightning payments as part of your business flow — this is the raw activity that generates yield potential.

- Deploy that volume onto a Rails node. Rails acts as the foundation for high-capacity, reliable payment routing.

- Automate liquidity management with Magma to optimize liquidity leasing.

- Earn Bitcoin rewards — Lightning volume that was once passive now works for you.

This setup transforms your node from a passive payment processor into a profit-generating gateway. With automated strategies, your node runs maintenance-free — yield generates as payments flow, all handled via API integration. Your team focuses on growing the business, while the infrastructure works in the background.

Example: High-Frequency, Real-Time Payments

Many businesses share a similar payment pattern: high transaction volume, small average payment size, compounding fees, and users who expect instant settlement. On traditional rails, this model is difficult to scale. Fees accumulate with every transaction, settlement lags behind user activity, and platforms remain exposed to banks and payment processors that weren't designed for real-time, global use cases.

Lightning changes the economics.

Because Lightning enables instant, low-cost payments at any size, platforms can move from absorbing fees to benefiting from payment flow. Instead of payments being a pure cost center, Lightning allows businesses to generate yield directly from user activity — earning on routing, liquidity provisioning, or payment flows tied to real usage.

A Concrete Example: Prediction Markets

Prediction markets illustrate this pattern clearly.

Users place frequent, small transactions during live events and expect immediate payouts when outcomes resolve. On card rails or bank transfers, fees and settlement delays compound quickly. High engagement becomes expensive.

With Lightning, these platforms can support fast micro-deposits and instant cash-outs while keeping capital in motion. Every transaction becomes an opportunity to earn — turning engagement into yield rather than margin loss.

High activity stops being a liability and starts becoming an advantage.

The Takeaway

Lightning allows businesses to reduce reliance on intermediaries, keep capital active and generate yield from the payment layer itself.

When payments are fast, programmable, and productive, growth doesn't just scale usage — it improves the economics of the platform.

Why Timing Matters

Lightning is still early. The advantage isn't just being early — it's building on top of Lightning now, before the majority of teams do. Companies that layer yield strategies on top of payment flows today won't be remembered as early adopters — they'll be remembered as right.

If you're ready to see how your business can start earning while accepting Lightning payments, check out our partnership with Voltage.

Or, schedule a walkthrough to see how other teams are fitting this into their current setup.