LINER

About

LINER stands for Lightning Network Rate and can be thought of as a "LIBOR" for the lightning network. Lightning node operators allocate liquidity in the form of lightning channels to one another in various duration channels or various sizes, which provides a valuable service to the network. The calculations below are aimed to simplify the complexity of duration, fee structures, and the lightning network to create easily digestible metrics for tracking the emerging lightning network economy.

What it means

The LINER Cost is the annualized rate paid for lightning channels. The LINER Cost is a standard benchmark index for the rate of payment for lightning channel leases of various sizes and durations. This is what a merchant would pay instead of payment card fees to a payment service provider.

The LINER Yield is the annualized rate of return for lightning node operators to allocate liquidity to one another for volume-weighted, variable duration channels. It is a standard benchmark index for the “risk-free” rate of return for lightning channel leases. The LINER Yield accounts for the costs of bitcoin transactions needed to create lightning channels.

How it's used

Both the LINER Cost and LINER Yield are indices used to measure the value of liquidity on the lightning network over time. Lightning node operators use such an index, which varies, to adjust rates to economic conditions including the cost of transactions on Bitcoin’s base layer (L1). The LINER metrics are also an indicator of the supply and demand of liquidity on the lightning network. These indices are backwards-looking and do not predict future market conditions.

LINER Cost is an index that is used to measure the cost of various liquidity transactions on the lightning network over time. When this index rate increases, the market cost of liquidity on the lightning network over the reporting period also increases.

LINER Yield is an index that is used to measure the rate of return of various liquidity transactions on the lightning network over time. When this index rate increases, the market return on liquidity on the lightning network over the reporting period also increases.

How it's calculated

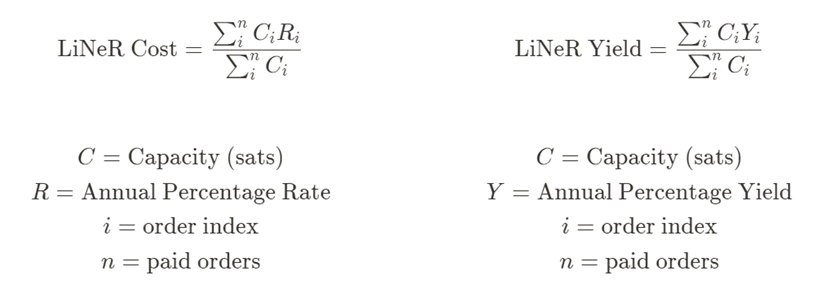

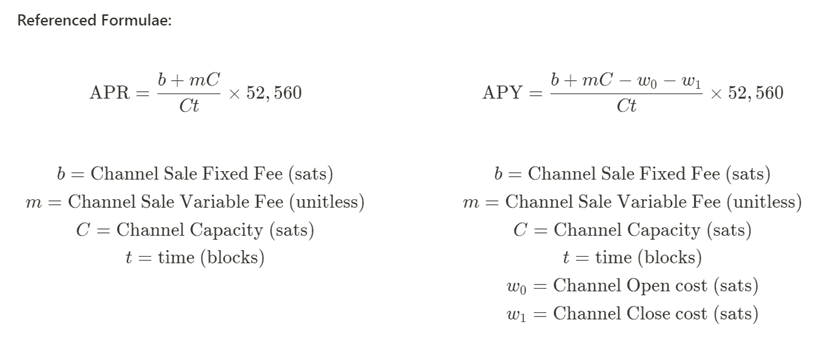

The LINER Cost is calculated using a capacity-weighted average of the Annual Percentage Rate (APR) paid for a lightning channel with a duration one week to several months.

The LINER Yield is calculated using the Annual Percentage Yield (APY) instead of the APR.

How LINER differs from lending

On the Lightning Network, node operators allocate bitcoin with another node on the network in a lightning channel, which is used for rapid settlement. Between the two nodes that share a channel, a ledger of signed lightning transactions is maintained that is separate from the Bitcoin Blockchain.

The most recent state of the ledger for each channel shows the ownership of funds within the lightning channel. The channel may be closed at any time and the bitcoin held within the channel will be distributed to each channel peer in accordance with the most recently signed state of the channel, in cooperative scenarios.

As ownership of the funds within the channel is determined by signatures from both nodes about the distribution of bitcoin within the channel, none of the actions within the lightning channel constitute borrowing or lending.

Sources of data

Due to the decentralized and private nature of the lightning network, it is impossible to have perfect visibility of the global LINER. We use data from the Amboss Magma channel marketplace for our calculations.

Disclaimer

Any information, opinion and ideas shared in this Amboss Technologies, Inc. (“Amboss”) documentation (the “Documentaion”) is intended for informational purposes only and are not to be construed as investment advice, financial advice or any offer to sell or attempt to market any security, digital asset, product or service. The information and opinions included in this Newsletter are not directed to any investors or potential investors and do not constitute an offer to sell or a solicitation of an offer to buy any securities, digital assets or any other product and may not be used or relied upon in evaluating the merits of any investment.

The Documentation or any associated content shared, commented on or endorsed on any other platform (i.e., social media accounts or websites) (including the personal accounts of Amboss’ employees; collectively, “Content Distribution Outlets”) should not be construed as or relied upon in any manner as investment, legal, tax, or other advice. Any discussion of laws, regulations or legal actions are intended to be for informational purposes only. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in the Newsletter are subject to change without notice.

Certain information contained in the Documentation may have been obtained from third-party sources. While taken from sources believed to be reliable, Amboss has not independently verified the accuracy of such information. Amboss does not have any obligations to verify the accuracy or update any of the content previously disclosed in the Documentation. In addition, the Documentation content may include third-party advertisements; Amboss has not reviewed such advertisements and does not endorse any advertising content contained therein.

Under no circumstances should any posts or other information provided by Amboss or on associated Content Distribution Outlets be construed as an endorsement of or offer to buy or sell any related securities. Nor should it be construed as an offer to provide investment advisory services.